Welcome……… Let’s dig into filing taxes as a low income person. Oh joy! 🤔

Let’s be honest: if you’re living on a low income, filing your taxes probably doesn’t feel like a priority. Maybe it even feels pointless. You might think, “I don’t make enough to owe anything anyway,” or “I’ll get around to it eventually.” Or maybe you’ve been burned before — told you owed when you couldn’t afford to pay, confused by paperwork you didn’t understand, or promised help that never really helped.

You’re not alone. For many people, especially those facing financial stress, the tax system feels like something designed for someone else — someone with a financial planner, a stack of receipts, and a clear head.

But here’s the truth: filing your taxes isn’t just for the rich, and it’s not just about what you owe. If you’re low income, it’s often the key to unlocking essential benefits — money that can help you cover rent, food, transportation, or medical expenses. It’s also one of the few financial systems in Canada that still offers support to those with very little. But you have to file to access it.

This isn’t about doing everything “right” or squeezing every dollar out of your return. It’s about learning how to navigate a system that impacts your financial life whether you engage with it or not — and making that system work for you, even if it wasn’t designed with you in mind.

This guide won’t throw jargon at you or pretend that filing taxes is easy for everyone. Instead, we’ll walk through what matters most if you’re trying to get it done on a low income:

✔ What paperwork you actually need

✔ Where to go for free help

✔ What benefits you could miss out on by skipping it

✔ How to avoid common traps (like thinking you have to pay to file)

And throughout, we’ll approach it through the lens of financial empowerment — because knowing how the system works (and how to work it back) is part of reclaiming control.

Let’s get started — not with a lecture, but with real tools to help you decide if now’s the right time to file, what to expect, and how to make the most of it if you do.

Filing Taxes on a Low Income: Why It Still Matters

If your income is low—or even non-existent—it can feel like filing your taxes doesn’t really matter. Maybe you didn’t earn enough to owe anything. Maybe you’ve been told it’s not worth the hassle. Maybe you’ve had stressful experiences in the past and want to avoid them at all costs.

But the truth is, filing your taxes is still one of the most important financial steps you can take each year—especially if your income is low.

Why? Because tax returns are how you unlock access to dozens of government benefits, programs, and payments that were designed for people just like you. That includes things like:

- the Canada Child Benefit (CCB)

- the GST/HST credit

- the Canada Carbon Rebate

- rent subsidies

- income-tested provincial supports

- retroactive payments (money you already qualified for but haven’t received)

If you don’t file, you don’t show up in the system—and that often means you’re missing out on hundreds or even thousands of dollars a year.

In this guide, we’re going to walk through the basics of tax filing from a low-income lens: what matters, what doesn’t, what to watch out for, and where to get real help—without judgment or pressure.

This isn’t about getting a gold star from the government. It’s about making sure the systems that were supposed to help you actually do help you.

What Do You Actually Need to File?

Filing your taxes doesn’t have to mean digging through a decade of papers or printing out a novel’s worth of forms. It’s about pulling together the key pieces that help the system recognize you—and determine what benefits you might be entitled to.

Here’s a quick breakdown of what you’ll likely need:

✔ Identification and Basic Info

You need:

- Your full legal name

- Social Insurance Number (SIN)

- Your current mailing address

- Your marital status

- The names, birthdates, and SINs (if they have them) for your dependents

This tells the system who you are—and how to match you to the right benefits.

✔ Your Income (Even If It Was Small or Spotty)

Even if your income was under the taxable threshold, or came from multiple small sources, reporting it matters. That includes:

- Part-time work

- Gig income (e.g., food delivery, babysitting)

- Self-employment (even informal)

- Social assistance

- EI or disability payments

- Student grants (some need to be declared)

Don’t overthink this part—you’re not being graded. You’re just giving an honest picture so they can calculate what you’re eligible for.

✔ Tax Slips (If You Got Them)

You may have received some of the following:

- T4: employment income

- T4A: gig, contract, or self-employment income

- T5007: social assistance or workers’ comp

- RC62: Universal Child Care Benefit (if applicable)

If you didn’t get a slip for something you earned, that doesn’t mean you skip it—it just means you may have to estimate or use your own records or reach out to a past employer. A free tax clinic can help with that if you’re unsure.

✔ Receipts for Deductions or Credits (Optional, But Helpful)

You don’t need a shoebox full of receipts to file your taxes, especially if your income is low. But a few kinds of paperwork might help you qualify for more:

- Rent receipts (some provinces offer credits)

- Medical or dental expenses

- Public transit passes (depending on the year/province)

- Childcare receipts

- Donations (if you made any)

You can still file without these—but if you have them, bring them.

That’s It. You Don’t Need Fancy Spreadsheets.

This isn’t about being perfect. It’s about being visible in the system so you’re not missing out. If you’ve never filed before, or haven’t filed in years, you can start now. You might even get retroactive benefits going back multiple years—but only if you file.

Next up: where to go for free help that won’t upsell you or make you feel small.

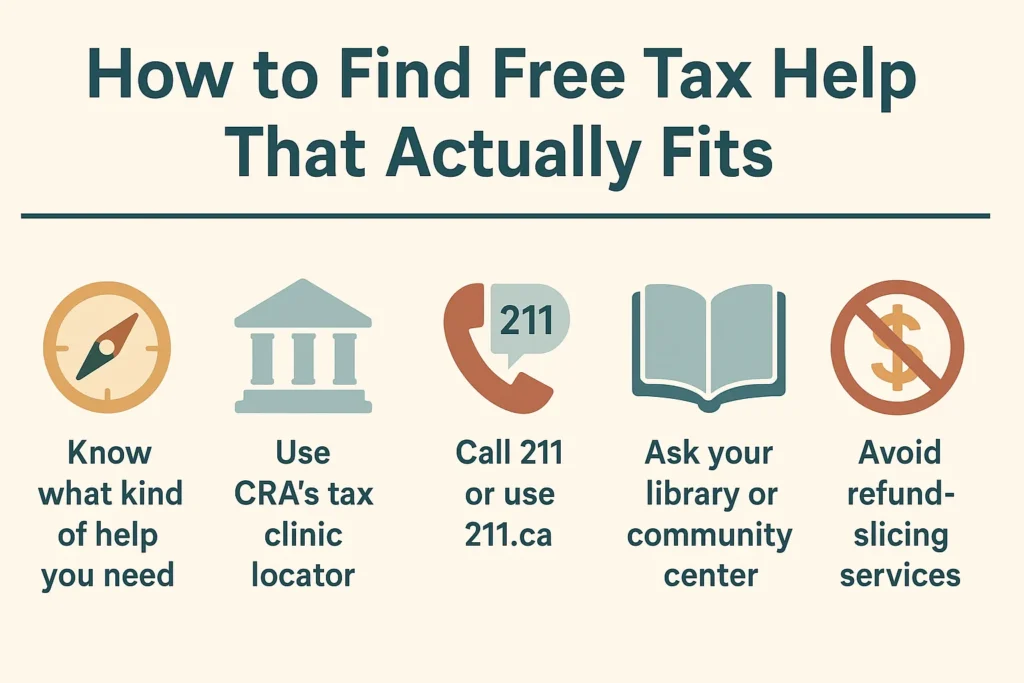

Where to Get Free Help Filing (Without Getting Lost in the Maze)

You shouldn’t have to pay hundreds of dollars just to file your taxes — especially when you’re already juggling every dollar you’ve got. The good news? You don’t have to. Free help does exist. But the tricky part isn’t knowing it’s out there — it’s figuring out where to find it based on your specific situation, right when you need it.

This section isn’t going to toss a list of websites at you that may or may not apply. Instead, we’re going to walk you through how to find help that actually fits — based on where you live, what kind of support you need, and how you prefer to interact.

Ask Yourself First: What Type of Help Do I Need?

Different people need different kinds of help. Some folks want to sit down across from a human who can explain things face to face. Others just need a bit of guidance online or a trustworthy platform that walks them through step by step.

Here’s a quick breakdown:

| If you prefer… | Try looking for… |

| In-person support | A local tax clinic in your community (usually hosted at libraries, community centres, schools, or non-profits) |

| Phone or virtual help | Free virtual tax clinics that walk you through filing by phone or video chat |

| Do-it-yourself, but with guidance | Online tools that are free for low-income users, often with support chat built in |

How to Find the Right Help — Step by Step

- Check your eligibility for free help.

Most free tax programs in Canada serve people with simple tax situations and under a certain income level. That includes most people who are:- On fixed or limited incomes (like disability, social assistance, or part-time work)

- Without self-employment or rental income

- Not running a business or claiming complicated deductions

- Start with the Canada Revenue Agency’s Free Tax Clinic Locator

This is the federal government’s central list. You can filter by:- Province or territory

- Language

- In-person vs. virtual help

- Date and availability

- Use your province’s 211 service (either online or by phone).

Visit 211.ca or dial 2-1-1 from your phone. This service helps you find local, free supports — including seasonal tax clinics, newcomer services, and Indigenous-led programs that may not be listed elsewhere. - Ask at your local library, community center, or social service office.

Many tax clinics don’t advertise widely online, but they do partner with organizations you already visit. If you’re unsure where to look, start local and ask, “Do you know if there are any free tax filing services around here?” - Avoid paid services that say they’ll ‘get you more.’

If someone’s advertising they’ll get you a “bigger refund” or “faster money,” but they want a cut of your return — walk away. They’re not offering anything that a free clinic or software can’t do — and they’re likely taking advantage of people in a tight spot.

If You Missed a Clinic This Year…

Don’t panic. Some online programs stay open year-round, and some community clinics will help with late filings or multiple years. If your income is low and you missed the April deadline, you might still be able to file and get your benefits retroactively.

Bottom Line

Finding free tax help isn’t about knowing a magic website — it’s about knowing how to search based on your life, your preferences, and your location. Use what you have, ask who you trust, and don’t be afraid to reach out.

You don’t need to do this alone. But you do deserve help that makes sense for your situation — not a one-size-fits-all handout or a sales pitch disguised as support.

How to File Your Taxes Yourself (Yes, You Really Can)

Before you head off in search of free tax clinics, it’s worth asking: Do I actually need help filing? Or do I just need a little more confidence and clarity to do it myself?

Because here’s the truth: filing your taxes isn’t nearly as complicated as it’s made out to be.

Most low-income tax returns are considered “simple” — and simple doesn’t mean “you’re missing out.” It means your income, benefits, and situation are straightforward enough that you probably don’t need to hire someone or wait in line at a tax clinic to get it done.

Why So Many People Don’t File on Their Own

It’s not because you’re lazy, or bad with money, or just can’t figure it out. It’s because no one taught us how the tax system actually works — and we’ve been led to believe it’s too complicated to handle without an expert.

But you don’t need a degree in finance. You just need:

✔ Clear, step-by-step instructions

✔ A little bit of time

✔ The right tool

Yes, There’s Software for That

Tools like TurboTax Free and Wealthsimple Tax make filing simple returns doable for anyone. These are free (or pay-what-you-can) programs that walk you through the process like an interview:

👉 What was your income?

👉 Did you get any benefits like the CCB or GST?

👉 Did you have medical expenses or move for work?

You answer the questions in plain language, and the software fills out the tax forms in the background.

You don’t even have to mail anything in. You can file online directly to the CRA using something called NETFILE — it’s fast, secure, and the easiest way to get your return processed and your refund (or benefit payment) out faster.

Not Sure Where to Start?

Here’s a quick example of what it might look like:

- Go to TurboTax Free or Wealthsimple Tax.

- Create an account (takes 2 minutes).

- Click “Start a new return.”

- Answer a few basic questions about your life (income source, province, marital status).

- The program will automatically walk you through the next steps — and tell you if you need extra info.

- When you’re done, review your return, hit “NETFILE,” and you’re done.

When DIY Might Feel Overwhelming — and That’s Okay

For some folks, filing on their own isn’t the right fit right now — and that has nothing to do with intelligence or ability.

Maybe you’re dealing with a tax mess from the past, a disability that makes digital filing hard, or a mountain of papers that feels impossible to sort through. Maybe someone did your taxes for you for years, and now you don’t know where to begin. Maybe you were paid under the table and aren’t sure how (or whether) to report it.

These situations don’t mean you can’t file your own taxes — just that having someone walk alongside you might make things easier this year.

Filing is still your choice. Help should never come with pressure, judgment, or shame. You deserve support that meets you where you are — not a lecture or a sales pitch.

Don’t Let Fear Cost You Money

Too many people end up paying for tax services they don’t need — or worse, don’t file at all because they’re afraid to “do it wrong.”

But every year you don’t file could be a year you miss out on benefits, credits, and retroactive payments that could make a real difference.

You don’t need to be an expert. You just need a tool that speaks human — and a bit of quiet time to walk through it.

You’ve got this. And if it ever feels too complicated, that’s when you go looking for help — not before you give yourself a chance to try.

When You Want Help: Finding Free Tax Support That Actually Fits

Even if you’re capable of doing your own taxes — and you probably are — there are still good reasons to reach out for help. Maybe you’ve got multiple slips and don’t know where to start. Maybe your income changed, or you got a letter from the CRA that you don’t understand. Or maybe you just want a second pair of eyes to make sure you’re not missing out on anything.

Here’s the good news: free help exists, and it’s not just for seniors or newcomers (though it’s there for them too). But the key is not just knowing it exists — it’s knowing how to find the kind of help that works for you.

Think about your situation:

- Do you prefer talking to someone in person — or is online help easier for you to manage?

- Are you confident with tech or would you rather have someone sit beside you and walk you through it?

- Are you doing a very simple return — or do you have multiple income sources, benefits, or debts that make things a little more complicated?

Based on your answers, here’s how to find the help that fits:

🧭 Search “free tax clinic + [your province or city]”

This is the fastest way to find local, in-person support. Community centres, libraries, and nonprofits often host clinics during tax season — and many are run through the Community Volunteer Income Tax Program (CVITP), a national program backed by the CRA. These are geared toward low-income individuals, and the volunteers are trained to help with simple returns.

💻 Check if your province offers its own help

Some provinces offer their own free or low-cost online services. Others have mobile outreach teams that help rural or remote residents. Type in your province’s name along with “file taxes free” and see what pops up. Just make sure it’s a government or trusted nonprofit site, not a paid ad disguised as free help.

🧠 Not sure what you’re eligible for? Use a benefits finder tool

Before or after you file, tools like Prosper Canada’s Wayfinder can help you discover what benefits you may qualify for — and tell you what tax forms you need to fill out to unlock them. It’s a great step if you want to make sure you’re not leaving money on the table.

🧾 Double-check that the help is actually free

Some places will say “free,” but only for the first 10 minutes — or only if you’re also buying another service. Always ask what’s covered, what’s not, and whether there are any income limits. Real free clinics will be upfront.

💸 What Benefits Could You Be Missing Out On?

If you’ve ever wondered whether filing your taxes is “worth it” when you don’t make much — this is the part where it becomes clear. Because for low-income individuals and families, a tax return isn’t just paperwork. It’s your access point. It’s how you show up in the system. And without it, you can be completely invisible — even when you’re the exact person these benefits were designed to support.

We’re talking about hundreds, sometimes thousands, of dollars every year in credits, rebates, and supports. Some are well-known. Some are deeply buried. But nearly all of them start with a filed return.

And the real kicker? You might already qualify for some of them — and just not be getting them.

Let’s change that.

🧭 Benefits Are Tied to Filing — Not to How Much You Owe

Here’s something the system doesn’t always make obvious: you can file your taxes even if you don’t owe anything, and still get money back.

This includes things like:

- GST/HST credit — a quarterly payment to help offset sales tax.

- Canada Carbon Rebate — based on your province, it can be a few hundred dollars a year.

- Canada Child Benefit (CCB) — monthly, tax-free payments if you’re raising children.

- Income-tested provincial benefits — including rental subsidies, prescription support, and utility rebates.

- Retroactive payments — yes, if you missed years, you might still be able to claim what was yours all along.

But here’s the catch: you don’t get these automatically.

They require up-to-date tax returns. That’s the gatekeeper.

🛠 Feeling Overwhelmed? There’s a Tool for That.

You shouldn’t need a law degree to figure out what you qualify for. That’s why Prosper Canada — a national leader in financial empowerment — developed something called the Wayfinder. It’s a free, user-friendly online tool that helps people find the benefits they’re eligible for, based on where they live, how much they earn, and what’s happening in their lives.

What If You Haven’t Filed in a While?

Let’s take a breath right here.

If it’s been a few years since you last filed — or if you’ve never filed — you’re not alone. You’re also not out of options. In fact, filing late is often a lot more doable (and rewarding) than people think.

Here’s what you need to know:

🕓 You Can File for Past Years

Canada’s tax system allows you to file late returns — even going back 10 years. That means if you haven’t filed since 2015, you can still catch up right now. And doing so might mean unlocking thousands of dollars in retroactive benefits like the GST credit, the Canada Child Benefit, or the Climate Action Incentive.

You don’t need to rush through them all in one sitting. Start with one year. Then the next. You can build momentum as you go — and many free tax clinics can help with multiple years, not just the current one.

💰 You Could Be Owed Money

One of the biggest misconceptions about filing late is that you’ll automatically owe money. Not true. If your income was low, there’s a good chance you didn’t owe taxes — but you might be missing out on refundable credits and benefits you already qualified for.

Filing is what puts you back on the map. It’s how the system sees you again — and how the support that’s meant for you finds its way to you.

🧾 You Don’t Need Every Slip to Start

If you’re missing paperwork, don’t panic. You can register for or log into your CRA My Account, where most tax slips and benefits info are available digitally. And if you don’t have access, a trained tax clinic volunteer or community navigator may be able to help you request the right documents.

⚠️ Be Careful of People Offering to “Clean It All Up” for a Fee

If someone says they can file your back taxes but wants a big chunk of your refund — or offers to “wipe the slate clean” for a fee — take a step back. Many of these services are predatory, especially when marketed to people in crisis. You don’t need to pay someone 20% of your refund to get what’s already yours.

Use trusted supports. Use free clinics. Ask questions. You deserve real help — not a quick fix that costs you in the long run.

Not Sure Where to Begin?

Start by gathering what you do know — your address history, any T4s or benefit slips you might still have, and a list of where you worked or what support you received. Even if it’s incomplete, it’s a beginning. You don’t need a perfect package to get started. You just need a starting point.

What Happens After You File?

Filing your taxes isn’t the finish line — but it does open the gate.

Once your return is submitted, here’s what you can expect next, and what to keep an eye on so you’re not left in the dark.

✔ CRA Will Process Your Return

For most online submissions, the Canada Revenue Agency (CRA) processes your return within two weeks. If you mailed it, it could take six to eight weeks or longer.

You’ll receive a Notice of Assessment (NOA) either in the mail or in your CRA My Account. This is the official document that confirms what the government calculated based on your return.

👉 Why it matters:

The NOA isn’t just paperwork — it’s your confirmation that your return was received, processed, and either accepted as-is or adjusted. If you’re eligible for benefits, this is often when those payments get triggered.

✔ Payments Might Start Flowing (If You’re Eligible)

Depending on your situation, once your return is processed you may start receiving things like:

- GST/HST Credit

- Canada Carbon Rebate

- Canada Child Benefit (CCB)

- Provincial/territorial tax credits

- Retroactive payments if you were eligible in previous years but hadn’t filed

👉 Watch for:

Direct deposit (if you’re signed up), or a cheque in the mail. Some benefits come quarterly, some monthly — and some only after your return is assessed.

✔ You Can Check or Fix Things in CRA My Account

Your CRA My Account is your tax filing command centre. It lets you:

- See what benefits you’re getting

- Review past years

- Check your NOA

- Set up direct deposit

- Fix errors or update info

Even if you don’t use it every day, having access matters. If you don’t already have an account, it’s worth setting one up once your return is submitted. (You’ll get a code by mail to finalize it.)

✔ You Might Get Follow-Up Mail — But Don’t Panic

Sometimes, CRA sends a request for clarification. That could mean they want to see a receipt, confirm your marital status, or clarify income from a specific source.

👉 What to do:

Respond by the deadline in the letter. You’re not being audited — they’re just making sure they’re giving out the right credits. If you’re unsure, a community tax clinic can help you understand and respond.

✔ If You’re Owed a Refund

For low-income individuals, this often isn’t a huge lump sum — but even small amounts can help cover essentials or go toward a goal.

If you have debt to CRA, some or all of your refund may be applied toward that balance. But even then, it’s better to know where things stand than stay stuck in the unknown.

Bottom Line

Filing your taxes is the action. What happens next is the ripple effect — and it can include real, tangible support.

Don’t just file and forget. Stay connected to what’s next. The system may not be perfect, but when you follow through, you create visibility — and visibility is what makes benefits possible.

Wrapping It Up: Filing Taxes Isn’t About Perfection — It’s About Access

If you’ve made it this far, take a breath.

Filing taxes on a low income isn’t just about getting a refund. It’s about getting seen by a system that often overlooks the people it was supposed to help. It’s about making space for benefits that are rightfully yours — not because you have to prove anything, but because your needs and your stability matter.

This isn’t about doing things the “government-approved” way. It’s about using the system to support your own goals, on your own terms. It’s about showing up — not to win gold stars, but to unlock what you’re already eligible for.

Whether you choose to file on your own, walk into a clinic, or ask someone to walk you through it step by step — it’s still your choice.

Whether you do it in February or July, one year or five — it still counts.

The goal isn’t to be perfect. The goal is to be in the system enough that the supports built into it can find you.

And when they do? You get a little more room to breathe.

Looking Ahead: This Is Just One Piece of the Puzzle

If this process felt hard, know that you’re not alone — and you’re not doing it wrong.

Sometimes, systems are hard on purpose.

That’s why support without pressure matters.

That’s why financial empowerment isn’t just about budgeting or saving — it’s about advocacy, clarity, and knowing what you can claim, ask for, and change.

In the Financial Empowerment Haven, we go deeper — not just into taxes, but into how to build real financial stability, without relying on guilt, hustle culture, or shame-based advice.

We explore:

- How to create budgeting systems that reflect your actual life

- How to plan for needs and wants, without cutting everything “fun”

- How to understand financial tools without being sold to

- How to make decisions based on your values, not your fears

And we do it together — with tools, stories, support, and real talk.

If It’s Feeling Like Too Much

Sometimes reading about taxes — especially when money’s already tight — brings up more than just confusion. It can stir panic, shame, frustration, or even numbness. That’s not failure. That’s a very normal response to being asked to navigate something hard with very little support.

If it’s all feeling like too much, it’s okay to pause. The financial system doesn’t always make room for the emotional weight of it — but that doesn’t mean you have to carry it alone.

Here are a few resources that offer calm, clarity, and human support:

📞 Talk Suicide Canada

For moments of crisis or overwhelm. Free, 24/7, non-judgmental support by phone or text.

Call or Text: 1-833-456-4566

Chat Online: https://talksuicide.ca

📱 Wellness Together Canada

Free mental health support, available any time — from live counselling to guided self-help tools for stress, anxiety, and burnout.

Visit: https://www.wellnesstogether.ca/en

🔍 211 Canada

A one-stop resource for local support across Canada — not just for taxes, but for housing, food, emotional support, and more. Available 24/7.

Call: 211

Search: https://211.ca

Tools & Resources That Can Actually Help

CRA My Account

Your tax command center: view slips, track refunds, check benefit eligibility.

➡️ https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html

TurboTax Free

Simple, free online tax filing — great for basic returns.

➡️ https://turbotax.intuit.ca/personal-tax-software/free-tax-software.jsp

Wealthsimple Tax

Pay-what-you-can tax software that guides you through each step.

➡️ https://www.wealthsimple.com/en-ca/product/tax

Prosper Canada Wayfinder Tool

See what benefits you’re missing out on — and how to claim them.

➡️ https://benefitswayfinder.org/

211 Canada

Find free tax help, community supports, and benefits info near you.

➡️ https://211.ca or just dial 211 on your phone

Community Volunteer Income Tax Program (CVITP)

Search for a local, free tax clinic in your area.

➡️ https://www.canada.ca/en/revenue-agency/services/tax/individuals/community-volunteer-income-tax-program.html

Still Feeling Overwhelmed?

That’s okay. You’re not expected to become a tax expert overnight.

This stuff was never designed to be easy — but it doesn’t have to stay confusing forever. One small step (even just booking an appointment or opening the Wayfinder) is enough to shift things forward.

You don’t need permission. You don’t need perfection.

You just need to start — and support that doesn’t treat you like a problem to solve.

🧾 How to Avoid Common Tax Filing Traps (Especially on a Tight Budget)

Filing your taxes shouldn’t feel like a gamble. But when you’re low income — and every dollar counts — it’s easy to get pulled into traps that promise quick results or sound too good to be true.

Here are a few to keep an eye out for — not to scare you, but to help you stay one step ahead.

❌ Trap #1: Paying Someone Who Promises You a “Bigger Refund”

If a tax preparer says they’ll “get you more” or “maximize your refund” but they want to take a cut of what you get back — stop right there.

That refund is your money. Most of what they’re doing is already built into free software or clinics — they’re just repackaging it with marketing.

Watch for red flags like:

- They don’t clearly state their fee up front.

- They base their fee on a percentage of your refund.

- They push you to sign forms you don’t understand.

If someone pressures you or uses fear to upsell you, walk away. There’s no magic button that gets you more than what you’re actually entitled to — and no one should take your benefit money to tell you otherwise.

❌ Trap #2: Paying for “Instant” Tax Refunds

Sometimes called “cash back” tax filing” or “refund advances,” these are services that offer to give you your refund up front — minus their “fee.”

It might sound helpful in a pinch. But often, the fee is way too high for what amounts to a short-term loan. That’s money out of your pocket for the sake of getting your return a few days faster.

Unless you’re facing a crisis and have no other option, it’s almost never worth it.

❌ Trap #3: Believing You Have to Pay to File

This one’s personal for a lot of people. If you’ve always gone to a big box tax store — or had a relative or friend say, “you’ve got to go to this place” — it might never have occurred to you that you could do it yourself or access real free help.

But you absolutely can. As you’ve already seen in earlier sections:

- Many simple returns can be done using free online software like Wealthsimple Tax or TurboTax Free.

- Community clinics exist across Canada, and they’re trained specifically to help people with low incomes file without pressure or judgment.

There’s no shame in asking for help, but there’s also no reason to assume you always need it. You’re allowed to explore what works best for you.

🚫 Bottom Line

Scammy services and predatory pricing thrive on urgency, fear, and confusion — especially when people are stretched thin.

But here’s the truth: the tax system already knows what you’re entitled to. You’re just reporting what’s true — not convincing someone to give you something extra.

So take your time. Ask questions. Use your judgment. And remember that filing your taxes should help you — not cost you what you don’t have to spare.

You can filter by federal or provincial supports, check for tax-related benefits, and even discover things you might not have known existed. And it’s updated regularly, so you’re not relying on out-of-date info or guesswork.

It won’t apply for the benefits on your behalf — but it’ll point you in the right direction, and tell you what you need to file or fill out to get started.

🧩 This Isn’t Just “Extra Money.” It’s About Financial Stability.

These aren’t bonuses. They’re lifelines. Money for food, shelter, transportation, medical care, and dignity.

When we talk about financial empowerment, this is a big part of it — not leaving money on the table that was meant to help you.

You don’t have to memorize every program.

You don’t have to figure it out alone.

You just have to file your taxes — and start exploring what might already be waiting for you.

Want More?

✨ Stay tuned for our upcoming post:

“Common Tax Traps (and How to Avoid Them — With a Bit of Behavioral Science)”

We’ll go deeper into the psychology behind why we procrastinate, get overwhelmed, or give up — and how to build small, smart habits that make tax time less awful next year.

But for now?

You showed up. You got informed. You took the first step.

And that matters.

Thank you for spending a little time engaging in your financial life.

💕 – Crystal from Counting Your Pennies

Join Financial Empowerment Haven Today!

FAQ: Filing Taxes on a Low Income (Without the Headache)

📌 Do I have to file taxes if I didn’t earn much this year?

No — not legally. But if you want access to benefits like the GST/HST credit, Canada Carbon Rebate, or the Canada Child Benefit, you do need to file. It’s not about owing; it’s about showing up in the system so you can receive what’s already meant for you.

📌 What if I didn’t get any T4s or paperwork this year?

You can still file. You’re allowed to estimate if needed. Start with what you know — your jobs, income sources, or benefits. Many slips are also available digitally through CRA My Account. A free tax clinic can help you piece it together if you’re unsure.

📌 Can I still file even if I missed the deadline?

Yes. The CRA lets you file for past years — even up to 10 years back. You might still qualify for retroactive benefits. Start with one year and build from there.

📌 What if I made some money “under the table” or did gig work?

That still counts as income. It doesn’t mean you’re in trouble — it means you’re allowed to report it, even if it wasn’t through a regular job. Being honest helps you access programs like the Canada Workers Benefit.

📌 Will I owe money if I file?

Not necessarily. If your income is low, chances are you won’t owe — and may even get a refund or credit. If you do owe, filing can still help you get on a payment plan or reduce penalties. Ignoring it won’t make it go away — but facing it might actually help.

📌 What if I’ve never filed before — or it’s been years?

That’s okay. It’s more common than you think. You can still file, catch up, and access missed benefits. You don’t need to do it all at once — just start.

📌 Can I file on my own or do I need to go to a clinic?

You can absolutely file your own taxes — especially if your situation is simple. Programs like TurboTax Free or Wealthsimple Tax walk you through it step-by-step. If it feels overwhelming, you can always reach out for help.

📌 How do I find free tax help that actually fits me?

Start here:

- 💬 Dial 211 or visit 211.ca to find local support in your province.

- 📍Use the CRA’s Free Tax Clinic Finder to see what’s available near you.

- 🧭 Check out Prosper Canada’s Wayfinder — a powerful, easy-to-use tool that helps you see what benefits you qualify for and what tax forms you need to file to get them.

The next article in this series — Common Tax Traps (and How to Avoid Them — With a Bit of Behavioral Science) — will explore why filing taxes can feel so overwhelming, how those stress responses are completely normal, and what small, realistic steps can help shift things. It’s not about willpower — it’s about wiring, and there are ways to work with it, not against it.