Introduction: It’s Not Laziness — It’s Survival

Let’s get something straight right from the start: avoiding your taxes isn’t a character flaw. It’s not laziness, irresponsibility, or proof that you’re “bad with money.” Most of the time, it’s your nervous system doing exactly what it was built to do — trying to protect you from something that feels overwhelming, confusing, or unsafe.

When you’re low income — or have dealt with financial trauma, systemic barriers, or years of trying to just make ends meet — tax season can hit a lot harder than people think. It’s not just about forms and numbers. It’s about fear, pressure, uncertainty, and the emotional weight of a system that hasn’t always treated you kindly.

This article is here to name those feelings — not dismiss them.

Because the truth is, most tax-time paralysis isn’t about not knowing what to do. It’s about the flood of everything that comes with trying to do it. The panic. The fog. The urge to shut down or push it off “just a little longer.”

But here’s the good news: those reactions are normal, explainable, and changeable. Not by “trying harder” or shaming yourself into action — but by understanding what’s happening in your brain and learning how to work with it, not against it.

This guide isn’t about discipline or hustle.

It’s about real tools, human behavior, and small steps that meet you where you are.

Let’s start with the science behind why tax-time avoidance shows up — and what to do when it does.

🧯 Fight, Flight… or Freeze (Especially at Tax Time)

You’ve heard of “fight or flight,” but there’s a third response that often gets overlooked — and it’s the one most common at tax time: freeze.

When your brain perceives a threat — even a non-physical one like a confusing letter from the CRA or a looming tax deadline — your nervous system kicks in. If it doesn’t think you can fight your way through it or run away from it, it chooses a third option: shut down.

Why Filing Taxes Can Feel Like a Threat

This isn’t about drama. It’s about what your brain and body learned over time. If any of these ring true, your freeze response makes perfect sense:

- You’ve filed before and got hit with unexpected debt. Now you avoid it to avoid repeating the pain.

- You grew up in a household where money and paperwork caused major stress. Your brain links taxes with chaos.

- You’ve been penalized or judged for making mistakes before. Now, perfectionism or fear of doing it “wrong” keeps you stuck.

- You’re already at max capacity — emotionally, mentally, or physically. Filing feels like one more thing you can’t handle.

It’s not about logic. It’s about how your nervous system prioritizes safety. And unfamiliar paperwork, deadlines, or bureaucratic language doesn’t feel safe when you’re already overwhelmed.

What Freeze Looks Like in Real Life

- Leaving the envelope from the CRA unopened

- Starting a return… then stopping halfway and never coming back

- Telling yourself “I’ll deal with it tomorrow” — every day for months

- Doing nothing because you don’t know the “right” way to do it

If you’ve ever felt paralyzed, foggy, exhausted, or frozen when facing taxes — that’s not failure. That’s a valid human response to chronic stress.

You’re Not Broken. You’re Wired for Protection.

The problem isn’t that you’re bad at taxes.

It’s that most systems don’t take into account what stress, poverty, trauma, or survival mode do to the human brain.

But once you understand that?

You can stop blaming yourself — and start finding ways forward that actually work for the way you are, not the way you’re “supposed” to be.

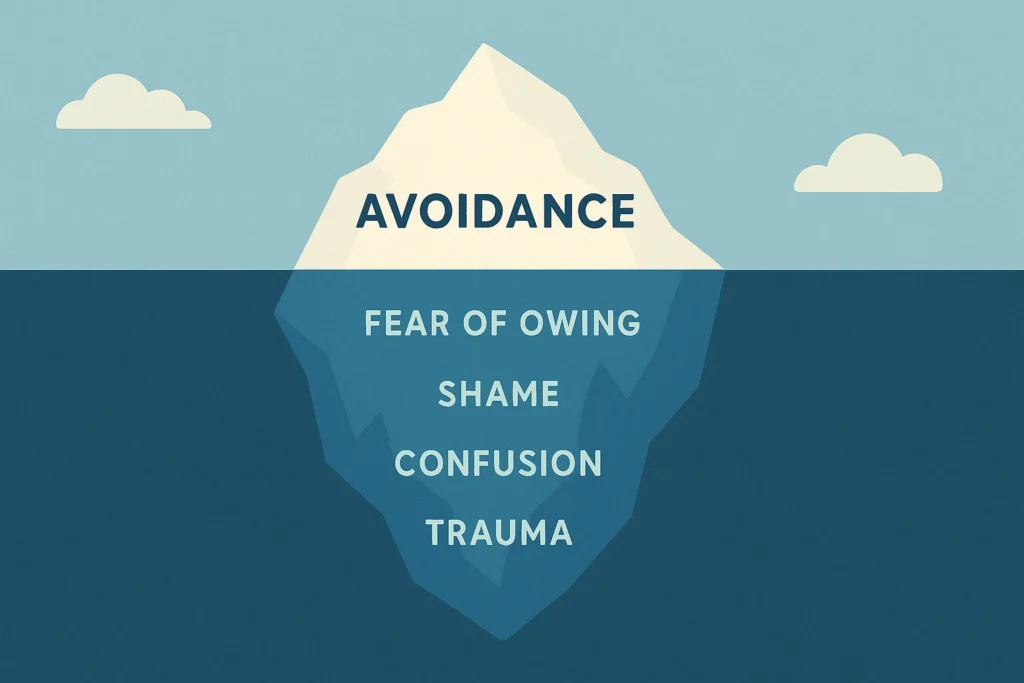

🔍 Naming the Triggers — What’s Really Going On When You Shut Down

The freeze response isn’t random. It’s usually sparked by a combination of inner and outer stressors — some obvious, some quiet, all valid. Naming them doesn’t just explain why filing taxes feels hard — it helps take back power from the shame and confusion.

Here are some of the most common freeze triggers when it comes to taxes:

➤ Fear of doing it wrong

Not “not knowing” — fearing the consequences of getting it wrong.

You’ve heard stories about audits. Penalties. Big scary bills. Even if your return is simple, the fear of messing up can feel huge. That fear tells your nervous system: don’t move. Better to do nothing than risk doing it wrong.

Try this instead:

Think of your first draft as just gathering puzzle pieces. You’re not locking in a final version — you’re collecting info. That softens the stakes. Just start getting your tax slips, then buy the tax software. One little step at a time.

➤ Fear of what you’ll find out

Sometimes the fear isn’t about the process. It’s about what the numbers will reveal.

Will you owe? Did you forget something? Are you “bad at this”? There’s a vulnerability in facing your financial truth, especially if it hasn’t felt safe before.

Try this instead:

Reframe it as a check-in, not a test. “I’m checking where things stand so I can decide my next move.” Curiosity opens doors that fear slams shut.

➤ Confusion from information overload

There’s too much advice, too many forms, too many rules. And most of it assumes you already know the basics — or have the time and energy to learn them.

Try this instead:

Set a 20-minute timer and pick one thing to look at:

- Just log in to CRA My Account

- Just list what tax slips you have

- Just read one trusted guide (like this one)

You’re not solving the whole thing. You’re clearing one branch from the path. This is progress.

➤ Shame

This one’s heavy. It says: “I should know this by now.”

Or “other people figure this out — why can’t I?”

Shame keeps us frozen because it tells us we don’t deserve support, or that asking for help confirms our failure.

Try this instead:

Shift from shame to story. You don’t have to blame yourself for the parts of life you were never taught, weren’t your fault or happened in the past. Naming that truth is powerful — and disarming. Name them and move on. People have failed you. Systems have failed you. You may have made choices that weren’t in your best interest. All true but irrelevant. The part of the story you can control is just this moment. So make a good next step and keep reading. This is part of your story now. Keep moving forward.

When you know the trigger, you can shift the response. And when you know the system isn’t neutral — that it’s confusing by design — you can stop internalizing the difficulty as your own failure.

You’re not the problem. You’re the reason this work matters. Keep moving.

🔄 Normalize It, Don’t Pathologize It

Freezing around money or taxes doesn’t mean you’re weak. It means your nervous system is doing exactly what it was built to do — protect you.

When things feel uncertain, high-stakes, or overwhelming, your brain doesn’t respond with logic and clarity. It responds with survival instincts: fight, flight, freeze, or fawn. For many people, especially those who’ve experienced poverty, trauma, or systems that weren’t made for them, the most common response isn’t fighting through the fear — it’s shutting down altogether.

You’re not lazy. You’re not irresponsible. You’re not failing.

You’re reacting — to stress, to complexity, to fear of messing something up or owing more than you can afford. And for good reason: financial systems are often confusing, judgmental, and stacked with consequences. Avoiding them isn’t irrational. It’s learned self-protection.

Why This Matters

When you see yourself as “bad with money” or “just not good at taxes,” you internalize a story that keeps you stuck. It’s not that you can’t do it — it’s that you’ve been taught you’re not allowed to make mistakes. You’ve been trained to see every error as a threat, not a learning moment.

That kind of pressure creates what behavioral scientists call threat-based responses. When our body interprets an experience as risky — even emotionally or especially emotionally — it diverts energy away from rational thought and problem-solving, and puts it into defense. That’s why you might suddenly feel tired, panicky, avoidant, or just completely shut down when you try to engage with tax forms.

And then what happens?

You avoid a little longer… and the fear gets louder.

You miss a deadline… and the shame grows.

You delay again… and it starts to feel like it’s too late.

But here’s the key: that reaction doesn’t mean you’re broken. It means your wiring is working. It’s just not wired for this particular kind of pressure — yet.

The Reframe: Treat Avoidance Like Information, Not Identity

Instead of asking, “Why can’t I just do this already?” try asking, “What is my avoidance trying to tell me?”

✔ Is it a lack of clarity about what to do next?

✔ Is it fear that I’ll do something wrong?

✔ Is it memories of being judged or shamed around money?

✔ Is it overwhelm from other parts of life that make this feel impossible right now?

Once you treat avoidance as a signal — not a character flaw — you can start to build a response plan that works with your brain, not against it.

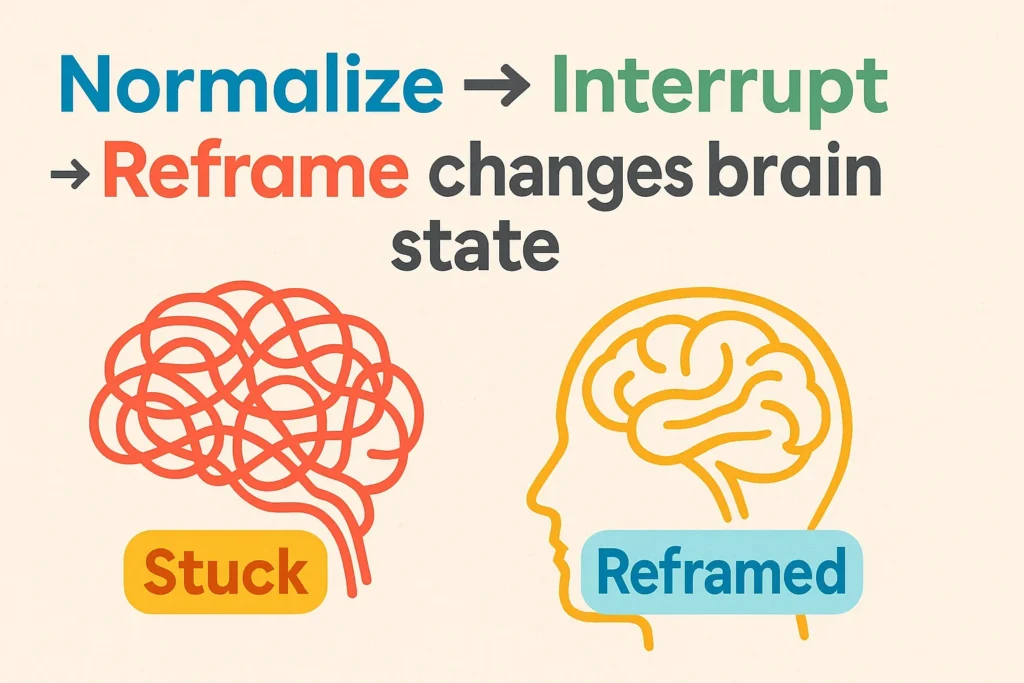

🧠 Behavioral Science in Action

Normalize. Interrupt. Reframe.

That’s the pattern. And it’s more than a feel-good mantra — it’s a grounded, evidence-based strategy rooted in how our brains actually process stress and behavior change.

Let’s break it down with a little more depth:

🔹 Normalize

Our default reaction to avoidance is often shame:

“Why am I like this?”

“Other people don’t freeze — what’s wrong with me?”

But those thoughts don’t move us forward. They dig us deeper into stuckness.

Instead, begin by naming the moment without judgment.

This isn’t giving yourself a free pass — it’s giving yourself enough space to breathe.

Say:

- “Of course I’m feeling stuck. This is hard.”

- “It makes sense I’d feel this way. These systems are confusing and stressful.”

- “This isn’t just a ‘me’ problem — a lot of people freeze in the face of financial fear.”

By normalizing the reaction, you loosen the grip of shame. And that’s what makes it possible to try something different.

🔹 Interrupt the Loop

Our brains crave familiar patterns — even when those patterns aren’t helpful. Avoidance becomes a loop:

Stress → Freeze → Delay → More Stress → Bigger Freeze

But the moment you name what’s happening, you create a tiny pause in that loop — and that pause is powerful.

Say:

- “I’m not lazy. I’m freezing because this feels overwhelming.”

- “I’m noticing my chest tightening just looking at these forms. That’s my nervous system reacting.”

- “I’m stuck in a spiral, and it’s okay to step out of it.”

This isn’t magic. It’s neuroscience. Labeling the emotion or reaction activates the prefrontal cortex — the part of the brain that helps you plan, decide, and take action. Once you’re out of panic mode, even just a little, you have more access to choice.

🔹 Reframe the Story

Once the loop is interrupted, your next move is to reframe the narrative — gently, honestly, and with compassion.

Say:

- “I don’t have to do everything. I just have to do one thing.”

- “This isn’t about catching up — it’s about starting today.”

- “It’s not too late. The timeline I thought I had wasn’t real — the opportunity still exists.”

Reframing isn’t about lying to yourself. It’s about making the path forward visible again.

It’s shifting from:

- “I’m behind and doomed” → to → “I can still take a step, and that step matters.”

- “I have to be perfect” → to → “I’m allowed to be in progress.”

🧭 Why This Works

When you normalize, you reduce shame.

When you interrupt, you regain clarity.

When you reframe, you restore momentum.

Together, these three small moves start to rewire the way your brain responds to financial stress — and that’s how behavior change actually begins.

This isn’t toxic positivity.

This is radical permission to meet yourself with clarity and care, even in the middle of the mess.

That’s not weakness. That’s strategy. That’s how you reclaim power from systems that were never built with you in mind.

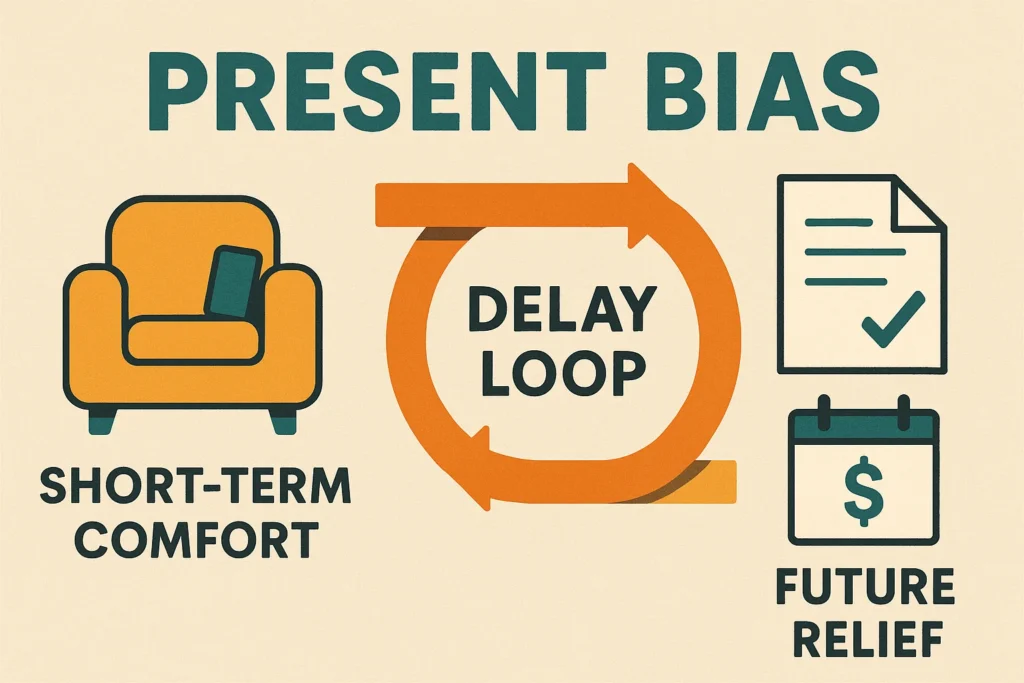

🧯 “I’ll Deal With It Later” Isn’t Laziness — It’s a Brain Hack Gone Sideways ( Present Bias )

One of the most common tax-time behaviors? Putting it off.

Again. And again.

You tell yourself you’ll get to it this weekend. Or after payday. Or when life calms down. But deep down, you’re not sure when that mythical “later” will arrive.

This isn’t a character flaw.

It’s not laziness.

It’s not a lack of discipline.

It’s present bias — a well-documented behavioral science concept that explains why we prioritize short-term comfort over long-term benefit.

Even when we know filing taxes could lead to money back or extra benefits, the discomfort we feel right now — stress, confusion, fear — outweighs that future upside. So we put it off. Again. And again.

🧠 What’s Actually Happening

Your brain is constantly managing your mental and emotional energy. When it senses that a task might be hard, confusing, or emotionally risky (like taxes when you’re low income), it tries to protect you — by helping you avoid it.

You’re not avoiding taxes because you don’t care.

You’re avoiding them because your brain sees the task as stressful and unrewarding, especially in the short term.

Filing your taxes might help your future self, but right now?

Your present self just wants to breathe.

This is present bias in action:

“Later-Me can deal with it. Right-Now-Me needs to feel better.”

The result? A short-term hit of relief that feels helpful — but kicks the real stress further down the road.

Another think to remember is….

Your brain is wired to avoid discomfort and seek relief — right now. Filing your taxes, especially when you’re stressed or broke, doesn’t give you that reward. It gives you anxiety, uncertainty, paperwork, and the threat of discovering something you don’t want to deal with.

So, your brain does what it’s evolved to do: it pushes the task off in favor of something more immediately soothing. Even if you know that long-term, avoiding it will make things harder.

This isn’t about discipline. It’s biology.

🔁 Why It Feels So Familiar

That relief loop is powerful. Every time you avoid your taxes and don’t immediately suffer for it, your brain says:

“See? That wasn’t so bad. Avoiding worked.”

You’re training your brain to equate avoidance with safety — and action with danger.

But over time, the weight of the delay gets heavier.

- The stack of paperwork feels bigger.

- The deadline feels closer.

- The shame starts to creep in.

That momentary relief turns into long-term avoidance. And now you’re not just stressed — you’re ashamed, overwhelmed, and even more stuck than before.

🔄 Rewiring the Response: What Helps Instead

The way out isn’t more shame. It’s smarter strategy.

Here’s what works — not because it’s motivational fluff, but because it’s grounded in how brains actually operate under pressure:

✔ Shrink the Task

Don’t set out to “file your taxes.” Set out to take one step:

- “I’ll just log in to my CRA My Account.”

- “I’ll grab my T4 from the drawer.”

- “I’ll open the tax software and stop there.”

When the task feels tiny, the brain doesn’t resist it.

And once you’re in motion, it’s easier to keep going.

✔ Tie It to a Habit or Trigger

Your brain loves routine. Use that to your advantage.

- “After I brush my teeth at night, I’ll spend five minutes on my return.”

- “Every Saturday before lunch, I’ll check off one tax-related item.”

You’re not relying on willpower — you’re anchoring action to something familiar.

✔ Use a Visual Countdown or Checklist

Make your progress visible. Break the process into small, trackable steps and check them off as you go. Example:

- ⬜ Find my tax slips

- ⬜ Log into CRA My Account

- ⬜ Enter personal info

- ⬜ Confirm benefits

- ⬜ Hit submit

Each checkmark tells your brain: “See? I can do this.”

And that feeling builds momentum.

✔ Offer Yourself a Soft Landing

Instead of promising yourself a “productive day,” promise yourself a kind one.

Say:

- “I only need 10 minutes of focus. Then I’ll rest.”

- “If I start to panic, I’ll stop and take a breath. That’s okay.”

- “I’m allowed to take this slowly.”

This trains your brain to associate the task with safety — not punishment.

🧭 Bottom Line

Avoidance doesn’t mean you’re broken.

It means your brain is trying to help — but it’s working off the wrong information.

By understanding present bias, you stop seeing yourself as “bad with money” and start seeing the real reason you’ve been stuck.

And once you name it, you can shift it — not by force, but with compassion and clarity.

You don’t have to finish it all today.

But you can take the next step — and that’s more than enough.

❌ Believing You Have to Pay to File

This one runs deep. If you’ve always gone to a chain tax preparer, or heard people say “you’ve got to go to this place — they’re the best,” it might never have crossed your mind that you don’t actually have to pay to file your taxes.

But for most low-income folks with a simple return, it’s absolutely possible — and often preferable — to file for free.

🔁 Why It Feels So Familiar

The belief that “real” tax help must cost money didn’t come out of nowhere.

Big-name tax businesses, marketing campaigns, and word-of-mouth all work together to build this idea that tax filing is too hard to do on your own — or too risky to trust to anyone but a paid expert.

That makes sense, especially if:

• You’ve had a bad experience trying to file on your own

• You were never taught how the tax system works

• You fear making a mistake that costs you later

• You’ve always handed it off to someone else and hoped for the best

And if the cost of paying someone has always felt “worth it” just to get it over with? You’re not alone. But that doesn’t mean it’s the only way — or even the best way.

🔄 Rewiring the Response: What Helps Instead

This isn’t about shaming people for using paid services. It’s about giving you options — and the clarity to decide what’s right for you, without fear or pressure.

Here’s what helps:

✔ Know What Counts as a “Simple Return”

If you have a regular T4 from a job, a few benefit slips (like GST or CCB), and no rental or business income, your return is likely considered “simple.”

Simple doesn’t mean “not worth filing.” It means you don’t need bells, whistles, or a price tag.

✔ Try Free Filing Software

Programs like TurboTax Free or Wealthsimple Tax walk you through your return step by step, in plain language. You don’t need to know tax rules — you just answer questions like:

• Did you receive income from work or benefits?

• Did you move or have medical expenses?

• Do you have dependents?

They’ll do the math and fill out the forms behind the scenes — and you file online through CRA’s secure NETFILE system.

✔ Watch for Red Flags at Paid Services

Not all paid help is shady — but if someone:

• Bases their fee on a percentage of your refund

• Pressures you to sign without explaining what you’re signing

• Promises they’ll “get you more money back”

That’s not help. That’s exploitation. Especially if they’re taking a cut of your benefit money to do what free tools could do just as well.

✔ Check First: Do You Even Need Help This Year?

If you’ve filed before and your situation hasn’t changed much, there’s a good chance you can handle it again — especially with clear instructions or a simple checklist.

You can always try a free tool first. If it feels confusing or too much, then reach out for help.

But don’t assume you have to pay — especially before giving yourself the chance to try.

🧭 Bottom Line

You don’t have to prove anything to do your taxes.

You don’t have to impress anyone.

And you definitely don’t have to pay someone just because it feels safer.

Explore your options. Ask questions. See what fits your situation, your comfort level, and your capacity.

Because filing should be about getting support — not giving up money you didn’t need to spend.

❌ “I’ll Owe and I Can’t Afford It”

This fear stops more people than almost anything else. The moment you think, “What if I file and find out I owe money I don’t have?” — your brain slams on the brakes.

Suddenly, it feels safer to avoid filing at all than to face a number you can’t pay.

But here’s what doesn’t get said enough:

You don’t have to have the money to file. And filing — even if you owe — opens the door to support, not just consequences.

🔁 Why It Feels So Familiar

If you’ve ever been hit with a surprise bill from the CRA — or seen someone else go through it — this fear is real.

• Maybe you did gig work and didn’t set aside taxes.

• Maybe you were overpaid a benefit, and they asked for it back.

• Maybe you just don’t trust that the government won’t penalize you if you make a mistake.

Add in stories about interest, late fees, or collections — and it makes sense why people freeze.

But here’s what often gets missed:

Avoiding your taxes doesn’t stop the problem. It delays it — and usually makes it worse.

🔄 Rewiring the Response: What Helps Instead

This isn’t about pretending the fear doesn’t exist. It’s about learning how to face it with tools, facts, and steps that actually work.

✔ File First, Then Deal With the Owing

The CRA doesn’t require you to pay your balance the day you file.

You can:

• File your return and get a Notice of Assessment

• See what (if anything) you owe

• Then explore payment plans, debt relief programs, or community support

Even if you can’t pay right now, filing shows good faith — and helps you avoid harsher penalties later on.

✔ Know That Support Exists (Yes, Even for This)

If you do owe, there are more options than most people realize:

• The CRA offers low-income payment arrangements

• Some debts may be paused or reduced based on your income

• Nonprofits (like local credit counselling agencies) can help you talk to CRA and negotiate on your behalf — often for free

You’re not the first person in this situation. You won’t be the last. But filing is what makes it possible to get help.

✔ Don’t Let One Year’s Mistake Define Every Year After

A lot of people who owe once never file again.

They’re scared to repeat the experience — or assume that every return will hurt them.

But every tax year is its own situation. And not filing for multiple years compounds the stress and the consequences.

You’re better off dealing with what’s real now than being haunted by what might be later.

✔ Use Filing as a Checkpoint — Not a Threat

Reframe the process. Say:

• “I’m filing so I know where I stand — not to punish myself.”

• “If I owe, I’ll explore my options — but I won’t let the fear control me.”

• “I’m stronger facing it than avoiding it.”

Filing gives you data. And data gives you choices.

🧭 Bottom Line

Fear of owing can keep you stuck for years. But the only way through it — and the only way toward real stability — is to file anyway.

You don’t need to be ready to pay.

You just need to be willing to face the truth gently, with support if you need it, and step by step.

It’s not a trap if you see it coming — and prepare with care instead of panic.

🧱 “This Is Just How It Is for People Like Me”(a.k.a. Identity-Based Hopelessness)

This one’s quiet. Heavy. And deeply familiar to anyone who’s been told — directly or indirectly — that they don’t matter.

When you’ve lived through years of financial strain… when support always comes with strings… when systems seem built for everyone else… it’s easy to internalize the idea that things like tax returns, benefits, or government programs aren’t for you.

You might catch yourself thinking:

- “Even if I file, it won’t change anything.”

- “They probably won’t give me anything anyway.”

- “I’m used to just scraping by — this is how it’s always been.”

This isn’t just fatigue. It’s a kind of learned resignation. A belief that says: hope is for other people.

But here’s the truth:

That belief didn’t start with you — and it doesn’t have to end with you either.

🔍 Where This Comes From

Behavioral science calls this learned helplessness — the idea that after facing enough setbacks, rejections, or dismissals, people stop trying. Not because they don’t care. But because they’ve been taught — often through painful experience — that effort doesn’t lead to reward.

But it’s not just psychological. It’s systemic.

If you’ve:

- Been denied help because your income was “too high” — but still not enough to live

- Had your benefits clawed back for working a few extra hours

- Watched others get support more easily because they “knew the system” better

…then yeah. That message sinks in.

Over time, “What’s the point?” becomes a survival strategy. It keeps you from wasting energy on false hope.

But here’s what’s also true:

It can change.

And filing your taxes — even if it feels small — is a way to start that shift.

🔄 Rewiring the Response: What Helps Instead

This isn’t about motivational posters or pretending everything is fine. It’s about slowly, deliberately, reclaiming your place in a system that doesn’t always make it easy.

Here’s what can help:

✔ Reclaim Your Visibility

Every time you file a return, you make yourself visible again. You say:

“I exist. I count. I’m in this system — and I’m not disappearing quietly.”

That alone can be radical.

✔ Separate the System from Your Worth

Just because a system failed you doesn’t mean you failed.

Say:

- “This system wasn’t built for me — but I’m still going to use what I can.”

- “I don’t need to trust the system to use it in service of my goals.”

You don’t owe the government your belief in their goodness. You just deserve access to what you’re eligible for.

✔ Anchor Your Actions to Your Values

Maybe you’re not filing just for yourself. Maybe it’s for your kids. Your future. Your peace of mind. Your proof that you tried, even when it was hard.

When the system feels too big or distant, connect your action to something closer to home.

Say:

- “This isn’t for them. It’s for me.”

- “Filing is how I keep the door open for what comes next.”

🧭 Bottom Line

Hopelessness isn’t a lack of motivation.

It’s the result of being let down too many times.

But you don’t have to stay stuck in that story.

You can write a new one — not because the system suddenly got better, but because you decided your visibility matters.

You’re not filing because you believe in the system.

You’re filing because you believe in you — and the possibility of more.

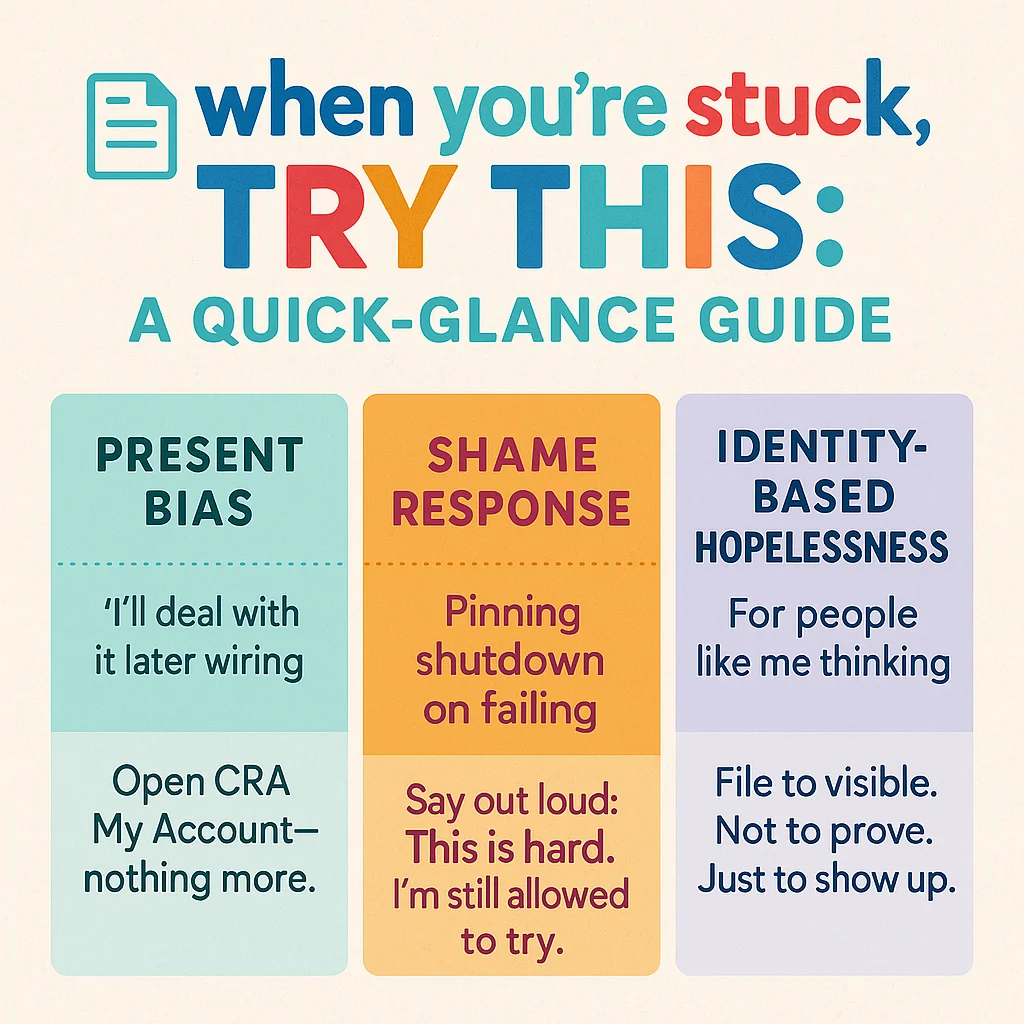

🧾 When You’re Stuck, Try This: A Quick-Glance Guide

Avoidance isn’t about being lazy. It’s about being human.

Here’s a quick-reference table to help you spot what’s going on — and take one small, doable step forward when the freeze kicks in.

| Trigger | What’s Going On (Behind the Scenes) | One Small Action to Try |

| “I’ll deal with it later.” | Present bias — the brain favors short-term relief over long-term gain. | Log in to your CRA My Account. You don’t have to do anything else yet. |

| “I don’t know where to start.” | Choice overload or analysis paralysis — too many options = doing nothing. | Pick one slip, benefit, or piece of info to look at — just one. |

| “I think I’ll owe — I don’t want to know.” | Fight-or-freeze — the brain is bracing for a threat, even if it’s uncertain. | Say: “I’m not committing to anything. I’m just checking where things stand.” |

| “Other people are better at this — why am I like this?” | Shame and comparison shut down your ability to take action. | Say: “It makes sense that this feels hard. I’m allowed to learn at my own pace.” |

| “It’s too late.” | Scarcity mindset — everything feels urgent and irreversible. | File anyway. Late is better than never. You can still get retroactive benefits. |

🧭 You don’t need to do everything today. You just need a way in.

Use what works. Leave what doesn’t. Come back when you’re ready.

🪞 Reflection Prompt: What’s Really Getting in the Way?

This isn’t about checking a box or proving something to anyone. It’s about starting a real, honest conversation with yourself — without shame, without pressure, and without pretending tax time isn’t hard.

Try this:

“When I think about filing my taxes, the first feeling that comes up is ___________.”

“One thing I wish someone would just tell me straight is ___________.”

“If I could wave a magic wand and feel one thing about this whole process, it would be ___________.”

You don’t have to have the “right” answers. You don’t even have to fix anything today.

But naming what’s true for you — out loud, in writing, in your own head — is how you shift from avoidance to agency. It’s how you break the freeze. Not by bulldozing through it, but by showing up with clarity and care.

🧭 This is part of your financial empowerment — the real kind. The kind that starts with understanding yourself, not judging yourself.

📌 Anchor Phrases to Keep You Grounded (When the Freeze Kicks In)

Sometimes you don’t need a whole strategy — you just need a sentence that brings you back to yourself. Something real. Something true. Something that cuts through the noise and reminds you that this doesn’t have to take you down.

Here are a few to try. Screenshot them. Write them down. Post one on your fridge. Say them out loud. Whisper them if you need to.

Whatever works — these words are here to hold the line when your brain wants to shut the door.

🟦 “This feels hard because it is. And I’m still allowed to try.”

🟦 “I don’t have to do all of it. I just have to start.”

🟦 “The system is confusing — not me.”

🟦 “This fear is old. I don’t have to live by it anymore.”

🟦 “Doing a little is still doing something.”

🟦 “This is part of taking up space in a system that wants me invisible.”

🟦 “I’m not behind. I’m right where I’m starting.”

🟦 “My story isn’t a failure. It’s information. And I can work with that.”

🟦 “I can stop, breathe, and come back later. That’s allowed.”

🧭 These aren’t affirmations to pretend everything’s okay. They’re reminders that you’re not powerless — even when it feels like you are.

✅ The Small Wins Checklist: Build Momentum Without Burning Out

Tax paralysis doesn’t break because you read a blog post. It breaks because you do one thing — then another. And those small wins? They add up.

This checklist isn’t about being perfect. It’s about giving yourself credit for moving at all. Even if you’re crawling. Even if you’re circling back. That’s still movement.

You can print this. Copy it into a journal. Screenshot it. Tweak it. Make a blank copy with just the headings. Check off what fits — or just use it as a reminder that every step counts.

🗂 Getting Grounded

- ⬜ I named what’s making this feel hard.

- ⬜ I said one anchor phrase out loud (even if I didn’t fully believe it).

- ⬜ I reminded myself: this system is confusing — I’m not.

🧾 Getting Started

- ⬜ I found one tax slip (T4, T5007, anything).

- ⬜ I logged in to CRA My Account — or wrote down my login info.

- ⬜ I opened a tax software (TurboTax Free, Wealthsimple Tax — whichever I trust).

- ⬜ I made a list of income sources or benefits I had last year.

🧭 Getting Unstuck

- ⬜ I set a 10-minute timer to “just try” something.

- ⬜ I paused instead of panicking — and came back later.

- ⬜ I reminded myself I can file late if I need to. This isn’t all-or-nothing.

💬 Getting Support

- ⬜ I searched for a free tax clinic in my area.

- ⬜ I asked someone I trust if they’ve filed yet — just to start the convo.

- ⬜ I looked up Prosper Canada’s Wayfinder tool to check for benefits.

- ⬜ I called 211 or another support line just to see what’s out there.

🧭 Bottom Line:

If you checked even one box, you’re doing this. You’re moving. And you’re allowed to go at your own pace.

Progress doesn’t have to be loud to be real.

🕊 Final Thought: You Don’t Have to Fix It All Today

If you’ve made it this far, take a breath.

Reading something this deep, this honest, and this rooted in behavior isn’t light work. It means you’re not just looking for information — you’re trying to understand what’s really going on, so you can finally move forward.

And that’s not small.

So if your nervous system is still buzzing, if you feel the urge to close the tab and run — know that that’s normal, too. This stuff touches more than numbers. It touches shame, identity, past choices, survival patterns. Of course it’s big.

But now? You’ve got language for it.

You’ve got tools.

You’ve got options.

And the next step — whatever it is — doesn’t have to be flashy or fast.

It just has to be yours.

Tax-time panic doesn’t mean you’re bad with money. It means you’re human. And humans can change patterns — not by trying harder, but by understanding deeper.

So rest. Or act. Or reflect.

Whatever comes next, let it come from care — not pressure.

You’re not behind. You’re beginning or you’re beginning again.

Either way you are moving forward.

Remember that!

Now go eat a cookie! 🍪 And pick your strategies, plan your goals and take small tiny action(s) each day.